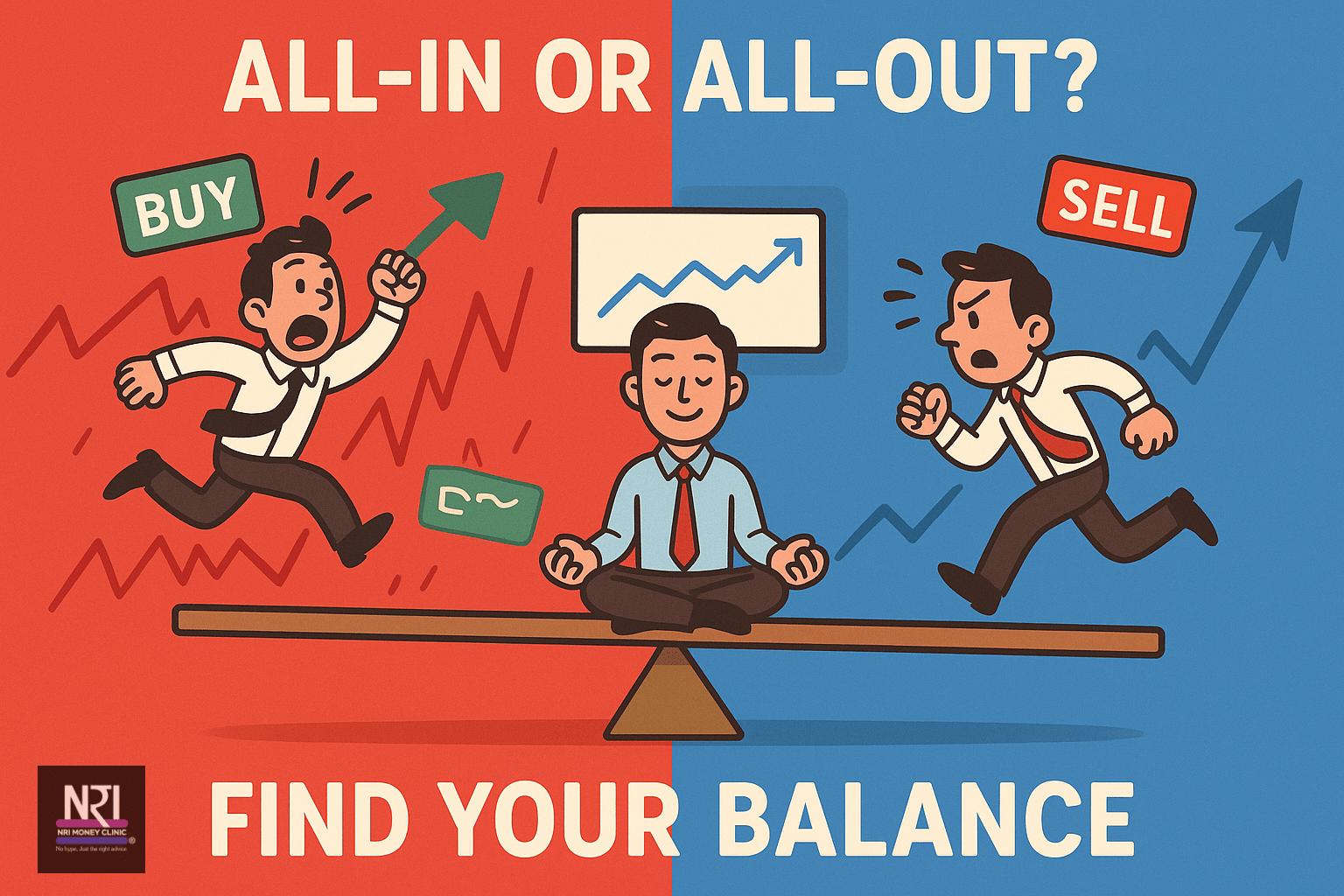

From 2020 to 2024, markets were the daily headline. Everyone wanted in. Then 2025 ambled in, refused to make new highs, and suddenly the very same people wanted out.

Sound familiar?

That “everything in / everything out” swing isn’t a strategy — it’s a mood. And moods don’t build wealth. If you’ve ever felt the urge to go 100% equity when the party’s loud (or 0% when it’s quiet), this guide is your antidote: a clear, practical way to invest like a grown-up in a noisy world.

The Problem: All or Nothing Is a Trap

All-in when you’re euphoric → you buy high, get overexposed, and panic when volatility shows up.

All-out when you’re fearful → you miss the turn, re-enter late, and chase at richer prices.

Markets are complex. Shocks happen (pandemics, credit cracks, policy surprises). If your portfolio only works when the world behaves, it isn’t a portfolio — it’s a wish.

Switch Your Brain: From “Certain” to “Probable”

Betting on a single outcome (“equities will definitely do 15% this year”) forces extreme decisions. Real investors think in ranges:

“Base case: decent returns over a cycle.”

“Downside: I still meet my minimum acceptable outcome.”

“Upside: I participate meaningfully if things go right.”

When you accept that multiple outcomes are possible, you naturally stop doing 0% or 100% moves and start doing something smarter…

The Cure: Diversification, Asset Allocation, and Position Sizing

1) Diversify on purpose

Own more than one asset class (equity, debt/cash, maybe gold/REITs depending on your context). Diversification is the antidote to emotional decisions during shocks.

2) Use asset allocation as rails

When valuations feel stretched and optimism is loud → be underweight equities (not out).

When fear dominates and prices are attractive → be overweight equities (not all-in).

Allocation bands keep you in the game, always.

3) Position sizing = power

Your return isn’t just percentage; it’s percentage × size. A 40% win on a tiny punt won’t move life. Aim to deploy meaningful amounts during attractive windows — not token amounts that make for great stories but tiny wealth.

The “Three C’s” That Actually Work

Forget waiting a decade for the perfect “crisis + cash + courage” moment. Most investors won’t pull the trigger when the screen is red. Try this instead:

Confusion: When narratives are messy (which is most of the time), prices are often fair. Invest anyway.

Clarity: By the time clarity arrives, prices usually reflect it. Expect lower future returns.

Conviction: Build a rules-based plan (SIP/STP, rebalancing bands) so you act from process, not headlines.

Bottom line: Invest during confusion, not after clarity.

Build a Durable Portfolio (That Survives Both Booms and Lulls)

A. Time

Give your equities market cycles, not months. Compounding needs calendars.

B. Discipline

Automate contributions (SIPs), pre-commit to rebalancing (e.g., review quarterly/half-yearly), and write your rules down.

C. Discretionary timing (a practical hack)

Split your spending into must-do vs nice-to-have:

When markets look cheap (wide fear, better valuations), postpone the SUV/renovation and invest a bit more.

When markets look frothy, prepone that planned spend — it gently trims equity exposure without tax drama.

D. Simple guardrails

Always keep some equity and some safety assets.

Set allocation bands (example: equity 50–70%). Only move inside the band; don’t jump from 0 to 100.

Scale entries with dollar-cost averaging; add lumpsums on clear valuation dislocations.

If You Entered at the Peak… Don’t Panic

Even a single additional purchase at lower levels can pull down your average cost and bring your portfolio back to green on a modest rebound. The key is to keep buying on process, not to freeze because the first ticket felt mistimed.

Your 7-Point Action Plan

Write your target allocation (e.g., Equity/Debt 60/40) and acceptable bands.

Automate monthly investing; don’t negotiate with yourself every payday.

Rebalance to targets on a fixed schedule (or when bands are breached).

Size your adds: when fear is high, deploy meaningful (pre-decided) amounts.

Avoid extremes: never 0% or 100% in any core asset class.

Separate goals: emergency fund and near-term goals stay out of equities.

Review annually: adjust only for life changes (income, dependents, horizon), not for headlines.

Do this and you’ll stop trading your portfolio for dopamine — and start building durable, real-world wealth.