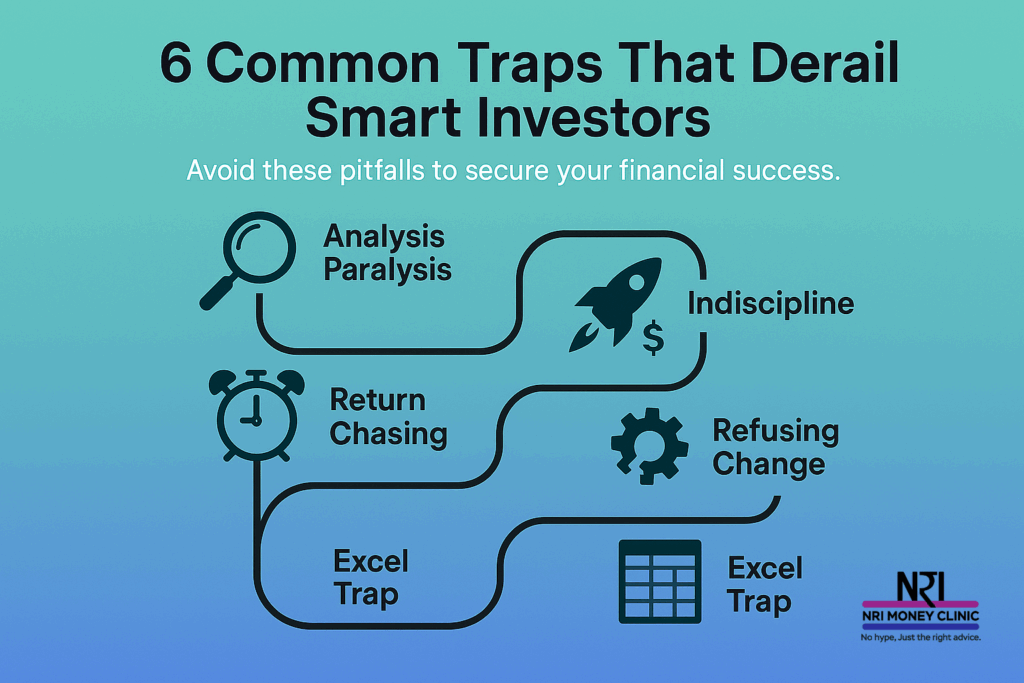

Successful investing isn’t just about choosing the right product or timing the market. It’s also about avoiding the traps that smart people often walk right into. In this article, we explore six common pitfalls that can silently ruin your investment journey—and how you can break free from them.

Trap 1: Analysis Paralysis

Ever found yourself stuck overthinking your next financial move? That’s analysis paralysis.

Many investors get caught up trying to find the perfect time, perfect plan, and the perfect advisor. The result? Endless research, zero action.

A classic case: An investor once approached us when the Sensex was at 12,000. After years of “reanalysing,” he returned—when the market had already climbed to 18,000. He missed the opportunity entirely.

How to escape: Set a clear deadline. Make the best decision you can with the available information—and remember, you can always refine your strategy as you go.

Trap 2: Indiscipline

You may choose the best fund, the best strategy, or even the best advisor. But without discipline? It all falls apart.

Skipping SIPs, ignoring EMIs, overspending on credit cards—these are signs of financial indiscipline that silently eat away at your wealth. You might end up making your credit card company richer, not yourself.

How to escape: Treat your commitments like non-negotiables. Budget at the beginning of the month, set up auto-debits, and stay consistent. You can only build wealth if you’re steady about it.

Trap 3: Chasing Returns

It’s tempting to invest in whatever’s trending—be it gold, real estate, or the hottest stock fund. But chasing returns is a losing game.

Today’s star performer may fizzle tomorrow. Worse, this mindset often leads to abandoning diversification and overloading on one asset class.

How to escape: Embrace asset allocation. Spread your investments across equity, debt, real estate, gold, etc. The real magic happens when out-of-favour assets rebound—and you were wise enough to have them in your portfolio.

Trap 4: Refusing to Embrace Change

Markets evolve. So do financial products.

But many investors get stuck in the past—trusting only old institutions or ignoring new, better solutions simply because they’re unfamiliar.

Remember how private insurance and banks were viewed with suspicion initially? Today, they dominate the market.

How to escape: Stay curious. Evaluate new offerings with an open mind. Change isn’t the enemy—resistance to it is.

Trap 5: Blindly Trusting Excel Projections

Excel sheets are great for budgeting, but terrible at predicting the future.

Projecting your retirement corpus 30 years ahead with fixed numbers for inflation, return, and currency value? It’s a good exercise, but not reality.

How to escape: Use Excel for planning—not prophecy. Keep flexibility in your projections and update them regularly as life and markets change.

Trap 6: Ignoring Common Sense

We all have it. But emotions—fear and greed—often silence it.

Fancy terms like IRR (Internal Rate of Return) can confuse more than clarify. For instance, a product with a 7% pre-tax return could leave you with far less after taxes, while a 7% tax-free option gives you the full benefit.

How to escape: Ground your decisions in simple logic. Compare returns after tax, not just on paper. Set realistic expectations—like aiming to beat inflation, not trying to outscore the market’s top performer.

Final Thought

Success in investing isn’t just about knowing what to do—it’s about knowing what not to fall for.

At NRI Money Clinic, we help you navigate these traps and build a solid, practical, and customized financial strategy. Whether you’re planning your retirement, your child’s education, or seeking steady cash flows—we’ve got the right experts to guide you.

📲 Want help with your financial plan?

Drop us a WhatsApp message using the link in the description. One of our team members will get in touch with you shortly. https://wa.link/q8rw62

No comment yet, add your voice below!