Markets love to talk about returns, products, and the next big fund. Real life money success is decided somewhere else. It lives in emotions, habits, and family conversations. Especially the conversations between spouses.

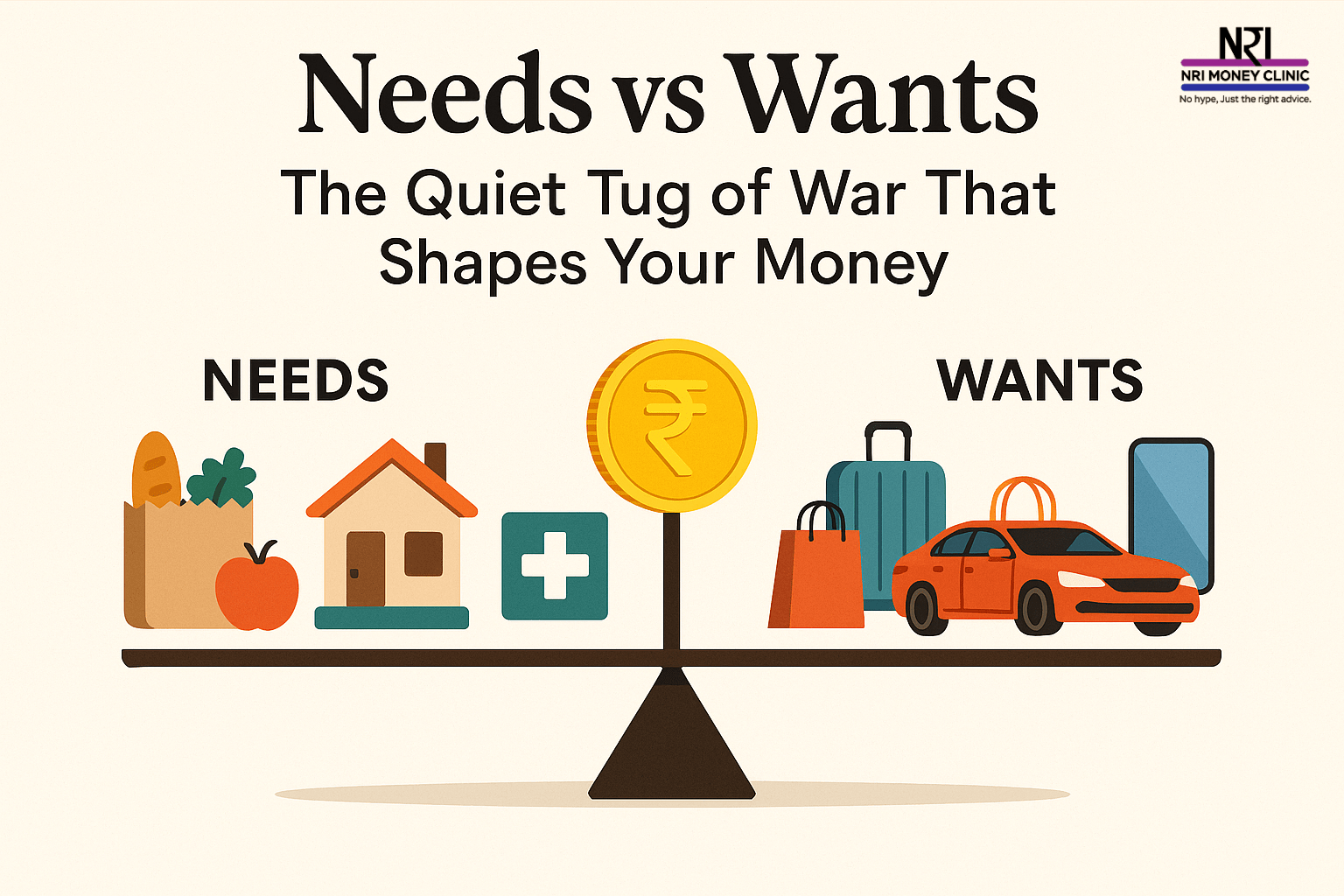

At the heart of many money wins and many money worries sits one simple tension. Needs and wants. Get this balance right and most of your plan clicks into place. Get it wrong and even great products struggle to save the day.

First things first

What is a need and what is a want.

Needs are non negotiable. Food, housing that is safe and adequate, healthcare, education, basic protection from uncertainty.

Wants make life richer. A better car, a world trip, a new phone, dinners out, an upgraded neighborhood or school. They are valid aspirations. They simply do not carry the same urgency.

The tricky part is that the line moves with context and with people. What feels like a need for one person can look like a want to another.

Why the line blurs inside a family

Spouses see different priorities. Fewer outfits vs a full wardrobe. Simple car vs feature loaded car. Quiet holiday vs a big trip.

Parents and kids live in different worlds. Functional gadget vs premium gadget. Tuition vs add on classes and activities.

Personal temperament matters. Some people need travel to feel alive. Others love a peaceful home weekend. The same spend feels different to each person.

This is not a right or wrong issue. It is a design issue. Design the conversation well and the plan works. Avoid the conversation and conflict moves into the plan.

How good planners defuse the needs vs wants conflict

1. Counseling mode

The planner acts as a neutral mirror. Clarifies what is need, what is want, what can wait, and what must be done now.

2. Budgeting mode

A clear monthly plan that funds shared needs first, then sets aside fair personal allowances for individual wants. Small freedoms prevent big fights.

3. Handholding with delayed gratification

Meet critical needs now. For wants, set a date and a savings track. Example, postpone the holiday by twelve months, start a travel pot today, avoid loans and guilt, still get the holiday later.

Golden rule

Needs first, wants later, but do not ignore wants. Ignoring wants looks frugal in the short run and backfires in the long run. Wants are how families celebrate progress. The trick is timing.

Use delayed gratification. Decide the want. Price it. Divide the cost by the months to the target date. Save calmly. Buy when ready. You get the joy without the debt.

The three life scenarios and what to do

1. Resources are tight

Focus on needs only.

Grow income. Change roles, add skills, consider a location change.

Avoid high cost debt. Especially credit cards and personal loans.

Include the family in decisions. Shared facts reduce friction.

2. Resources are just enough

This is the slippery zone. Comfort today can hide risk tomorrow.

Make retirement saving a top line item.

Keep wants, but always with a delay and a savings track.

Keep pushing income upward so the buffer grows, not shrinks.

3. Resources are plentiful

Abundance can breed inefficiency.

Audit where money sits. Too much in fixed deposits creates reinvestment and tax drag.

Simplify scattered real estate.

Build a portfolio that pays predictable income and also beats inflation.

Use a financial planner. You get one retirement. Get it right.

Practical playbook you can start this week

Step 1. List all needs

Housing, food, utilities, school fees, healthcare, base insurance, emergency fund.

Step 2. List top five wants

Write why each matters. If a want has deep personal value, call it out. Honesty lowers friction.

Step 3. Ring fence needs

Automate monthly funding. Non negotiable.

Step 4. Create two want pots

Family want pot for shared goals. Personal want pots for individual joy. Small monthly amounts work wonders.

Step 5. Use the twelve month rule

If a want is big, give it twelve months of saving. Buy later, sleep better.

Step 6. Schedule the chat

Fifteen minutes every month with your spouse. What worked, what slipped, what changes next month.

Hidden needs that often get missed

Health insurance for the family, not just employer cover

Emergency fund that truly covers three to six months of costs

Protection for the non investing spouse clear records, nominations, and access to money

Education planning started early so loans are a choice, not a scramble

A quick word on lifestyle

Lifestyle is for your well being, not for applause. The moment lifestyle becomes a show, costs rise and satisfaction falls. Before a lifestyle upgrade, ask three questions.

Can we sustain this if income drops

Will this upgrade crowd out critical goals

If a health or job shock hits, does this become a burden

If the answers feel solid, go ahead. If not, set a later date and save toward it.

The calm conclusion

Needs keep you safe. Wants keep you inspired. Balance both with honesty and a plan. Fund needs first. Give wants a date and a savings path. Invite your spouse and children into the process. Your products and returns will work far better when your behavior and relationships work first.